|

Phone: 212-971-9244 Email: alexy@foxbusinessfunding.com Learn More |

Since: January 2020 Since: January 2020 | |

Registered sales-based financing provider in VA Registered sales-based financing provider in VA |

Related Videos

Alex Yosefi of Fox Business Funding on the Red Carpet | Danny Guyton of Fox Business Funding at Broker Fair 2023 |

Stories

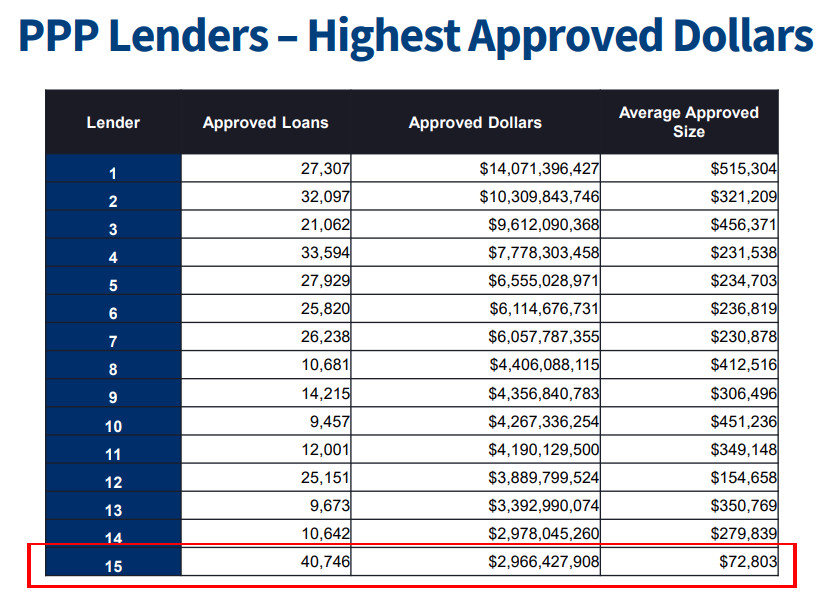

Ready Capital Was The Biggest PPP Lender By Volume in Round 1 of PPP Funding

April 22, 2020 Ready Capital, a multi-strategy real estate finance company and one of the largest non-bank SBA lenders in the country, was the top PPP lender by loan volume in the country. Company CEO Thomas Capasse appeared on Fox Business yesterday and announced key statistics that aligned with data published by the SBA. By dollars, Ready Capital was the 15th largest PPP lender.

Ready Capital, a multi-strategy real estate finance company and one of the largest non-bank SBA lenders in the country, was the top PPP lender by loan volume in the country. Company CEO Thomas Capasse appeared on Fox Business yesterday and announced key statistics that aligned with data published by the SBA. By dollars, Ready Capital was the 15th largest PPP lender.

“As a leading non-bank, SBA lender, there’s 14 of us, we’re number two in terms of originations last year,” Capasse said on Fox Business, “we focused broadly, we don’t have deposit relationships, so we open our doors broadly to in particular the smaller mom and pop, the local deli, the pizzeria, the nail salon, so just in terms of the numbers, round one of the PPP, we approved 40,000 loans which is number one in the US, it was about $3 billion in total approvals. And our average balance was only $73,000 versus $230,000 for the average in round one.”

Among Ready Capital’s channels for acquiring PPP loan applications is Lendio, who reported consistent figures (a rough average of $80,000 per PPP loan facilitated), and high volume. Lendio has said on social media that they have been working with several partners, Ready Capital among them.

Ready Capital’s Capasse reasoned that their speed could probably be attributed to an affiliated fintech lender. “We are maybe more efficient than some of the banks because we have an affiliated fintech lender which is able to create online portals and processes to work in a more efficient manner and that enabled us to not only process these loans more efficiently but also to provide broad access to the program, to the smaller business owners.”

The company acquired Knight Capital, a small business finance provider, late last year.

Sam Hodges on Fox Business

September 30, 2015Funding Circle’s Sam Hodges appeared on Fox Business on Monday, September 28th. One of the things he said is that loans under $1 million are still out of reach for most small businesses.

He also mentioned that his company has the lowest loss level of any digital small business lender anywhere in the world.

Details about Funding Circle disclosed:

- $1 billion lent to more than 10,000 businesses

- 40,000 investors globally

- $25,000 to $500,000 small business loans

Watch the full video below:

All Registered Sales-based Financing Providers in Virginia (As of 3-29-23)

April 2, 2023Is the revenue-based financing provider you do business with registered to operate in Virginia? On July 1, 2022, Virginia’s commercial financing disclosure law went into effect and with that the necessity to register one’s business. As of March 29, 2023, 101 companies had registered. This is the official list of registered sales-based financing providers as of that date (yellow means it has been added since our last update):

- Advance Servicing Inc.

- Accredited Business Solutions LLC dba The Accredited Group

- Advance Funds Network LLC dba Advance Funds Network

- AdvancePoint Capital LLC dba advancepoint

- Ally Merchant Services LLC

- Alpine Funding Partners, LLC

- Business Capital LLC

- Byzfunder NY LLC dba Tandem dba Nano-FI

- Bridge Capital Services, LLC

- CFG Merchant Solutions, LLC

- Clarify Capital II LLC dba Clarify Capital

- Cloudfund VA LLC dba Cloudfund LLC

- Capflow Funding Group Managers LLC

- Clear Finance Technology (U.S.) Corp. dba Clearco

- Coast Premier LLC dba Coast Funding

- Commercial Servicing Company, LLC

- Corporate Lodging Consultants, Inc.

- Crown Funding Source LLC dba Crown Funding Source

- Diesel Funding LLC

- Direct Capital Source Inc.

- Dealstruck Capital LLC

- EBF Holdings, LLC

- Essential Funding Group Inc

- Errant Ventures LLC

- FC Capital Holdings, LLC FundCanna

- Fidelity Funding Group LLC

- Front Capital LLC

- Finova Capital, LLC

- Fintegra, LLC

- First Data Merchant Services LLC

- First Path Capital Ventures LLC dba First Path Capital

- FleetCor Technologies Operating Company, LLC

- Flexibility Capital Inc.

- Fora Financial East LLC

- Forward Financing LLC

- Fox Capital Group Inc.

- Fundamental Capital LLC

- Funding Metrics, LLC dba Quick Fix Capital

- Good Funding, LLC

- Granite Merchant Funding, LLC

- Invision Funding LLC

- Itria Ventures LLC

- Jaydee Ventures, LLC dba 1 West Capital dba 1 West Commercial

- Kapitus LLC

- Knight Capital Funding III, LLC

- Lexington Capital Holdings Ltd

- LG Funding LLC

- Legend Advance Funding II, LLC dba Legend Funding

- Liberis US Inc.

- Libertas Funding, LLC

- Liquidibee 1 LLC dba Liquidibee LLC dba Altfunding.com

- Loanability, Inc.

- Millstone Funding Inc.

- National Funding, Inc.

- Nav Technologies, Inc.

- Orange Advance LLC

- Pearl Alpha Funding, LLC

- Pearl Beta Funding, LLC

- Pearl Delta Funding, LLC

- Proto Financial Corp.

- PWCC Marketplace, LLC

- Parafin, Inc.

- PayPal, Inc.

- Payability Commercial Factors, LLC

- Pinnacle Business Funding LLC dba Custom Capital USA dba EnN OD Capital

- Platform Funding LLC

- Prosperum Capital Partners LLC dba Arsenal Funding

- QFS Capital LLC

- RFG USA Inc.

- Rival Funding, LLC

- Riverpoint Financial Group Inc.

- Rocket Capital NY LLC

- ROKFI LLC

- Ruby Capital Group LLC

- Rapid Financial Services, LLC

- Reliant Services Group, LLC

- Retail Capital LLC dba Credibly

- Revenued LLC

- Rewards Network Establishment Services Inc.

- Secure Capital Solutions Inc.

- Sky Bridge Business Funding, LLC

- SMB Compass LLC dba SMB Compass

- Sunrise Funding LLC

- Santa Barbara Tax Products Group, LLC

- SellersFunding Corp.

- Sharpe Capital, LLC

- Shine Capital Group LLC

- Shopify Capital Inc.

- Shore Funding Solutions Inc.

- Streamline Funding, LLC

- Stripe Brokering, Inc.

- The LCF Group, Inc.

- Unique Funding Solutions LLC

- United Capital Source Inc.

- Upfront Rent Holdings LLC

- Upper Line Capital LLC

- Vader Servicing, LLC

- Velocity Capital Group LLC

- Vivian Capital Group LLC

- Vox Funding, LLC

- ZING Funding I, LLC

All Registered Sales-based Financing Providers in Virginia (List)

March 11, 2023Is the revenue-based financing provider you do business with registered to operate in Virginia? On July 1, 2022, Virginia’s commercial financing disclosure law went into effect and with that the necessity to register one’s business. As of March 8, 2023, this is the official list of registered sales-based financing providers:

- Advance Servicing Inc.

- Accredited Business Solutions LLC dba The Accredited Group

- Advance Funds Network LLC dba Advance Funds Network

- AdvancePoint Capital LLC dba advancepoint

- Ally Merchant Services LLC

- Alpine Funding Partners, LLC

- Business Capital LLC

- Byzfunder NY LLC dba Tandem dba Nano-FI

- Bridge Capital Services, LLC

- CFG Merchant Solutions, LLC

- Clarify Capital II LLC dba Clarify Capital

- Cloudfund VA LLC dba Cloudfund LLC

- Capflow Funding Group Managers LLC

- Clear Finance Technology (U.S.) Corp. dba Clearco

- Coast Premier LLC dba Coast Funding

- Commercial Servicing Company, LLC

- Corporate Lodging Consultants, Inc.

- Crown Funding Source LLC dba Crown Funding Source

- Diesel Funding LLC

- Direct Capital Source Inc.

- Dealstruck Capital LLC

- EBF Holdings, LLC

- Essential Funding Group Inc

- Errant Ventures LLC

- FC Capital Holdings, LLC FundCanna

- Fidelity Funding Group LLC

- Front Capital LLC

- Finova Capital, LLC

- Fintegra, LLC

- First Data Merchant Services LLC

- FleetCor Technologies Operating Company, LLC

- Flexibility Capital Inc.

- Fora Financial East LLC

- Forward Financing LLC

- Fox Capital Group Inc.

- Fundamental Capital LLC

- Funding Metrics, LLC dba Quick Fix Capital

- Good Funding, LLC

- Granite Merchant Funding, LLC

- Invision Funding LLC

- Itria Ventures LLC

- Jaydee Ventures, LLC dba 1 West Capital dba 1 West Commercial

- Kapitus LLC

- Knight Capital Funding III, LLC

- Lexington Capital Holdings Ltd

- LG Funding LLC

- Legend Advance Funding II, LLC dba Legend Funding

- Liberis US Inc.

- Libertas Funding, LLC

- Liquidibee 1 LLC dba Liquidibee LLC dba Altfunding.com

- Loanability, Inc.

- Millstone Funding Inc.

- National Funding, Inc.

- Nav Technologies, Inc.

- Pearl Alpha Funding, LLC

- Pearl Beta Funding, LLC

- Pearl Delta Funding, LLC

- Proto Financial Corp.

- PWCC Marketplace, LLC

- Parafin, Inc.

- PayPal, Inc.

- Payability Commercial Factors, LLC

- Pinnacle Business Funding LLC dba Custom Capital USA dba EnN OD Capital

- Platform Funding LLC

- Prosperum Capital Partners LLC dba Arsenal Funding

- QFS Capital LLC

- RFG USA Inc.

- Rival Funding, LLC

- Riverpoint Financial Group Inc.

- Rocket Capital NY LLC

- ROKFI LLC

- Ruby Capital Group LLC

- Rapid Financial Services, LLC

- Reliant Services Group, LLC

- Retail Capital LLC dba Credibly

- Revenued LLC

- Rewards Network Establishment Services Inc.

- Secure Capital Solutions Inc.

- Sky Bridge Business Funding, LLC

- SMB Compass LLC dba SMB Compass

- Santa Barbara Tax Products Group, LLC

- SellersFunding Corp.

- Sharpe Capital, LLC

- Shine Capital Group LLC

- Shopify Capital Inc.

- Shore Funding Solutions Inc.

- Streamline Funding, LLC

- Stripe Brokering, Inc.

- The LCF Group, Inc.

- United Capital Source Inc.

- Upfront Rent Holdings LLC

- Upper Line Capital LLC

- Vader Servicing, LLC

- Velocity Capital Group LLC

- Vivian Capital Group LLC

- Vox Funding, LLC

- ZING Funding I, LLC

When The Music Stopped: How The Pandemic Threatened the History and Culture of Austin, Texas

November 15, 2020

In April of this year, Threadgill’s – a legendary Austin music venue and beer joint that, in the 1960s, famously launched the career of blues singer Janis Joplin — turned off the lights and pulled the plug on its sound stage.

A converted gasoline station, Threadgill’s had been a rollicking music scene since 1933 when musician and bootlegger Kenneth Threadgill secured the first liquor license in Texas after Prohibition. His juke box was crammed with Jimmie Rodgers songs and Threadgill himself famously sang and yodeled Rodgers’ tunes.

For generations of students at the University of Texas, Threadgill’s was a rite of passage.

For generations of students at the University of Texas, Threadgill’s was a rite of passage.

“The first time I went to Threadgill’s was in the fall of 1968, when I was a freshman at UT,” recalls Perry Raybuck, a songwriter-folksinger and retired government worker who, as a member of the Southwest Regional Folk Alliance, played the stage in 2018. “It was the beginning of an education for me,” he adds. “I had been a Beatles and rock n’ roll kid and it opened me up to different music styles. I became a convert.”

In 1981, Threadgill’s was taken over by another acclaimed club owner, Eddie Wilson, who previously had been the proprietor of the Armadillo, a fabled music venue. Wilson began to actually pay musicians – Threadgill had compensated them mainly with free cold beer – and installed a circular stage.

It was Threadgill’s and an assortment of funky clubs and stages with names like the Soap Creek Saloon and Liberty Lunch helped put Austin on the map as “The Live Music Capital of the World.” The city remains home to the widely acclaimed television program “Austin City Limits” on PBS and the internationally renowned South by Southwest festival, which was canceled this year amid fears of a “superspread” of the coronavirus.

It was Threadgill’s and an assortment of funky clubs and stages with names like the Soap Creek Saloon and Liberty Lunch helped put Austin on the map as “The Live Music Capital of the World.” The city remains home to the widely acclaimed television program “Austin City Limits” on PBS and the internationally renowned South by Southwest festival, which was canceled this year amid fears of a “superspread” of the coronavirus.

“Live music,” says Laura Huffman, chief executive at the Austin Chamber of Commerce, “is why people come here. It is a central component of Austin’s cultural and economic life.”

Omar Lozano, director of music marketing for Visit Austin, the city’s main tourism organization, says: “We have close to 250 places in the greater Austin region where you can hear live-music, although it’s closer to 50-70 on any given night. During South by Southwest, no stone is left unturned — everything becomes a stage: parking garages, grocery stores, housing co-ops. There are also four or five stages at the Airport, which helps liven up the mood.”

But that identity is being put to the test. So far this year, Austin has lost a raft of live music venues. Among those joining Threadgill’s in honky-tonk heaven since the pandemic struck are Barracuda, Plush, Scratchhouse, Shady Grove, and Botticelli, all of which provided niche audiences to both established musicians and up-and-coming acts.

The roller-coaster ride of government mandated shutdowns followed by a limited re-opening in the spring and another shutdown since July fourth is making life miserable and untenable for both club owners and already hardpressed musicians and artists, says Marcia Ball, a piano player and blues singer.

Ball, who was named by the Texas Legislature as “2018 Texas State Musician” and whose musical style was once described by the Boston Globe as “mixing Louisiana swamp rock and smoldering Texas blues,” told deBanked: “There was already a limited amount of opportunity for musicians to perform and monetize their work in Austin, so it has always been necessary to travel to make a living. But we still depend on a thriving local scene, and we’re losing that when key venues like Threadgill’s disappear.”

Adds Graham Williams, a prominent Texas promoter of touring bands: “These venues and bars are vital to the music ecosystem. Local bands and cover bands need hangouts, even if people are not buying tickets. They’re places to play every night of week.”

While unheralded outside the Austin scene, the local music joints were often a port-of-call for out-of-town promoters and nightclub owners checking out Austin talent – “most notably Barracuda (which) had super-popular acts and was like a hipster garage venue,” says promoter Williams. “A lot of touring bands played there on their way up.”

A July study by the Hobby School of Public Affairs at the University of Houston found that the city’s live music industry is in desperate straits. Sixty-two percent of live music spots and 55% of the bar-and-restaurant businesses reported to researchers that that they can endure for no more than four months, making them the most vulnerable of 16 industries surveyed.

And the situation has become “even more ominous” since the report was published, explains Mark P. Jones, a political scientist at Rice University in Houston and a lead researcher on the Hobby study. “That survey finished polling two hours before all bars and restaurants closed back down,” he says. “Everything people were saying was when bars were at 50% capacity. That’s a best-case scenario.”

Austin’s experience amid the Covid-19 pandemic mirrors what is occurring nationwide as bars, nightclubs and music halls in myriad cities and towns experience similar trauma. In Seattle, Steven Severin is co-owner of three nightclubs – Neumos, Barboza and recently opened Life on Mars – all in trendy Capitol Hill, the hub of the city’s club and live-music scene. He reports that he is barely holding on thanks to some help from the city and a sympathetic landlord who is “a big music advocate.”

Austin’s experience amid the Covid-19 pandemic mirrors what is occurring nationwide as bars, nightclubs and music halls in myriad cities and towns experience similar trauma. In Seattle, Steven Severin is co-owner of three nightclubs – Neumos, Barboza and recently opened Life on Mars – all in trendy Capitol Hill, the hub of the city’s club and live-music scene. He reports that he is barely holding on thanks to some help from the city and a sympathetic landlord who is “a big music advocate.”

“He knocked down the rent a little bit,” Severin says of his landlord, but the situation is dire. “We just had a fifth venue, Re bar, close at the end of August,” he says. “It was a punch in the gut. This could be me.”

The Bitter End in Greenwich Village is also keeping its head above water despite not opening its doors since March. The nightclub has a storied past: owner Paul Rizzo recounts that it is where pop singer Neil Diamond got his start and where “everyone from Curtis Mayfield to Randy Newman” has performed since its opening in 1961. But the club is silent now since the pandemic overwhelmed the city’s hospitals and made New York the epicenter of sickness and suffering during the spring. So far the club is getting help from a landlord’s forbearance and loyal musicians.

Peter Yarrow (the “Peter” in the bygone trio Peter, Paul and Mary), donated a streamed concert to patrons who contributed to a fundraiser that raised more than $50,000. And grateful local musicians also put on a benefit directing people to a Go Fund Me page on the Internet that raised another $16,000. “We’re a major venue for local musicians,” Rizzo says. “We should pull through.”

It’s in their self-interest for artists to do whatever they can to keep the doors open at a club like The Bitter End. “These days because of the last two decades of declining record sales — live music is the bread and butter of a musician’s income,” says journalist Edna Gundersen, a recently retired, 28-year-veteran of USA Today. “That’s true whether it’s a local entertainer or an international superstar.” (Gundersen earned the reputation as Bob Dylan’s favorite journalist; it was she who scored his only interview after he won the Nobel Prize for literature in 2018, publishing his eccentric musings in the The Telegraph of London and breaking the news that he would indeed accept the prize.)

“Touring has been crushed,” Gundersen adds, “and festivals have been canceled. So people doing the circuit and clubs are gone for all intents and purposes. Streaming — while initially up — is down because people aren’t listening to music in the gym or in their cars. Physical record sales are also down because people aren’t going to stores. All of this is just killing musicians.”

The Paycheck Protection Program, the multi-billion, multi-tranche aid package for small business which Congress authorized as part of the CARES Act in March, has provided some funding for the live-music and entertainment industry. But because of the PPP’s requirements that only 40% of the funds can be spent on rent, mortgage and utilities, which are major expenses for nightclubs and music venues, the program has largely been a disappointment.

The Paycheck Protection Program, the multi-billion, multi-tranche aid package for small business which Congress authorized as part of the CARES Act in March, has provided some funding for the live-music and entertainment industry. But because of the PPP’s requirements that only 40% of the funds can be spent on rent, mortgage and utilities, which are major expenses for nightclubs and music venues, the program has largely been a disappointment.

Hoping to win attention and assistance for their plight from the federal government — “We’re the first to close and the last to reopen,” Severin says — live-music entrepreneurs like himself and Rizzo and more than 2,800 club-owners and promoters across the country have banded together to form the National Independent Venue Association.

Their membership includes independent proprietors (no corporate members allowed) of saloons, cabarets and concert halls as well as theaters, opera houses and auditoriums from every state plus the District of Columbia. To help plead their case with Congress, the organization hired powerhouse law firm Akin Gump Strauss Hauer & Feld, the largest Washington, D.C. lobbying firm by revenue.

NIVA also blanketed Congressional offices with two million letters, e mails and correspondence generated from hordes of fans and performers. Among the many scriveners are a slew of boldface names: Mavis Staples, Lady Gaga, Willie Nelson, Billy Joel, Earth Wind & Fire, and Leon Bridges. Comedians Jerry Seinfeld, Jay Leno and Jeff Foxworthy have also penned notes to lawmakers championing NIVA’s cause.

Their message: without federal funding, 90% of independent stages will go under over the next few months. “The heartbreak of watching venues close is that once a building is boarded up, it’s not going to be a music venue any more,” warns Audrey Fix Schaefer, communications director at NIVA. “They operate on thin business margins to begin with and they’re too hard to develop.” For touring acts, each city stage is “an integral part of the music ecosystem,” Schaefer explains. “When artists finally do get back on the tour bus, they might have to skip the next five cities and go on to the sixth.”

Thanks to the bi-partisan efforts of Senator Amy Klobuchar (D-Minn.) and Senator John Cornyn (R-Texas), NIVA’s campaign has gotten traction. The unlikely couple have teamed up to author a rescue bill, known as the Save Our Stages Act. If enacted, it would establish a $10 billion grant program for live venue operators, promoters, producers, and talent representatives.

Thanks to the bi-partisan efforts of Senator Amy Klobuchar (D-Minn.) and Senator John Cornyn (R-Texas), NIVA’s campaign has gotten traction. The unlikely couple have teamed up to author a rescue bill, known as the Save Our Stages Act. If enacted, it would establish a $10 billion grant program for live venue operators, promoters, producers, and talent representatives.

The legislation would provide grants up to $12 million for live entertainment venues to defray most business expenses incurred since March, including payroll and employees’ health insurance, rent, utilities, mortgage, personal protection equipment, and payments to independent contractors.

NIVA’s chief argument for the legislation is coldly economic rather than sentimentally cultural. The organization cites a 2008 study by the University of Chicago that spending by music patrons produces a “multiplier effect” for the broader economy. For every dollar spent by a concert-goer at a live performance, the Chicago study determined, $12 in downstream economic activity occurs.

Explains Scott Plusquellec, nightlife business advocate for the City of Seattle: “You buy a ticket to a show and the direct economic impact of that purchase is that it pays the artist, bartender and the club itself as well as the band, advertisers, and promoters. The indirect economic impact,” he adds, “is that after you bought the ticket, you went to a barber shop or a hair salon to look good that night. You might also have dinner, go to a bar for a drink and tip the bartender. That’s the whole the idea of a ‘multiplier.’”

In Austin, that economic logic is an article of faith with city burghers, asserts Lozano of Visit Austin, who reports that live music in the capital city is roughly a $2 billion industry. To promote live music, the tourism bureau sponsors such endeavors as “Hire an Austin Musician.” That program, Lozano says, “sends musicians around the U.S. to represent us during marketing season.” In another promotional campaign, Visit Austin arranged for singer-songwriter Julian Acosta to play a gig at travel agents’ offices in London when Norwegian Air inaugurated direct flights between London and Austin in 2018. “The U.K. is one of our best markets,” he reports.

Even so, efforts by the business community and the City of Austin have failed to stanch much of the industry’s bleeding. According to its website, the city has disbursed $23.7 million in loans and grants to small businesses and individuals, but slightly less than $1 million of that has gone to live-music and performance venues, entertainment and nightlife, and live-music production and studios.

In late September, The city of Austin’s Economic Development Department released a slide show breaking down how the $981,842 in industry grants and loans – of which $484,776 was provided by the federal government under the CARES Act – were awarded. Most top recipients appeared to be well known nightclubs and entertainment venues downtown or close to the city’s inner core.

In late September, The city of Austin’s Economic Development Department released a slide show breaking down how the $981,842 in industry grants and loans – of which $484,776 was provided by the federal government under the CARES Act – were awarded. Most top recipients appeared to be well known nightclubs and entertainment venues downtown or close to the city’s inner core.

The Continental Club on South Congress – a key fixture in the hip “SoCo” strip just over the Colorado River from downtown – appeared to do best. It picked up $79,919 from two programs: $40,000 in the CARES-backed small business grants program, and $34,919 from the city’s Creative Space Disaster Relief Program. Other clubs receiving $40,000 in the small business grants program included Stubbs, The Belmont, Cheer Up Charlies and the White Horse. (For a full list go to: http://www.austintexas.gov/edims/document.cfm?id=347299)

Joe Ables, owner of the Saxon Pub, a major Austin venue for jazz – blues singer Ball hailed it as one of several important Austin clubs “that sustains creative endeavor, especially for songwriters” – was vexed that his grant application was denied by the city “with no explanation.” Ables also voiced dissatisfaction that the city paid the Better Business Bureau a 5% administration fee to handle $1.14 million in relief funds, including determining which applicants were approved. “What would they know about live music,” he says.

Even for clubs that received city largesse, it hasn’t been nearly enough to sustain them. The North Door, which got $15,240, closed for good on September 11 (an ominous day — the anniversary of the attacks on the World Trade Center and the Pentagon.)

Meanwhile, enough clubs and venues were left out in the cold that club owner Stephen Sternschein could tell deBanked just before the slide show was released: “I’ve heard talk of a $21 million grant program but most people I know haven’t seen a dollar of that.”

Sternschein is managing partner of Heard Presents, an independent promoter and operator of a triad of downtown clubs that includes the spacious Empire Garage, which features hip hop and urban jazz, and has space for 1000 music-goers. A member of NIVA, Sternschein describes efforts by both the state and local governments as “woefully inadequate.” Says he: “People are looking to the federal government for answers.”

The diminution of places for musicians to ply their trade is a double edged sword. If Austin loses its luster as a hot music town, it puts the city’s overall economy in jeopardy. Explains Jones, the Rice political scientist: “The difficulty for Austin is that it could lose its comparative advantage. Unlike restaurants, movie theaters or sports events, which people can find just as easily in other cities, the Austin music scene draws capital and revenue from across the country.

The diminution of places for musicians to ply their trade is a double edged sword. If Austin loses its luster as a hot music town, it puts the city’s overall economy in jeopardy. Explains Jones, the Rice political scientist: “The difficulty for Austin is that it could lose its comparative advantage. Unlike restaurants, movie theaters or sports events, which people can find just as easily in other cities, the Austin music scene draws capital and revenue from across the country.

“You can go out to dinner in Waco,” he observes, referring to the mid sized Texas city between Austin and Dallas best known as home to Baylor University and its “Bears” football team, fervent Baptist religiosity, and unremarkable night life. “Music brings in revenue to Austin and to Texas that wouldn’t otherwise come here.”

In addition, Jones says, the large presence of “artists, creative types, and freelancers” helps make Austin a strong selling point for “brain industries” to attract talent from the East and West Coasts. “It supports the technology industry by making it easier to recruit employees to live there,” he says. “Austin is an alternative to Silicon Valley. People who are progressive might be hesitant to come to conservative, red-state Texas from California but they’ll come to Austin because it’s culturally cool.”

Austin, which embraces the slogan “Keep Austin Weird,” is on the verge of becoming just like every place else in Texas. Should it relinquish its flavor and charm, it could discourage many of the assorted business groups and professionals from keeping Austin on their dance card as a popular destination for meetings, conferences and get-away trips.

Howard Freidman, managing director at Bluechip Jets, a broker of private luxury aircraft, had an earlier career as a technology industry executive. Partly drawn by his previous experiences with the city, Freidman moved to Austin earlier this year. “It had the same coolness and weirdness of New Orleans — but also with the professionalism of a tech city,” he says.

“Whenever we’d come here,” Freidman adds, “the music was always integral to the Austin scene. Even when you’d go to private parties you’d end up downtown at the club scene on Sixth Street. Austin was always a place everybody liked going to.”But as Austin has steadily been morphing into more of a high-technology center than a live-music town, it’s experiencing a silent exodus of musicians and artists who are being gentrified out of their apartments and Craftsman duplexes. Displacing them are software engineers, website designers and the like, their sleek BMWs and black, tinted-glass SUVs glistening in the parking lots of steel-and-glass corporate centers.

“Whenever we’d come here,” Freidman adds, “the music was always integral to the Austin scene. Even when you’d go to private parties you’d end up downtown at the club scene on Sixth Street. Austin was always a place everybody liked going to.”But as Austin has steadily been morphing into more of a high-technology center than a live-music town, it’s experiencing a silent exodus of musicians and artists who are being gentrified out of their apartments and Craftsman duplexes. Displacing them are software engineers, website designers and the like, their sleek BMWs and black, tinted-glass SUVs glistening in the parking lots of steel-and-glass corporate centers.

Many of the technology firms – including such needy companies as Samsung, Intel, Rackspace, Facebook, and Apple – have each received tax breaks, grants and subsidies worth tens of millions of dollars from a variety of local jurisdictions. Not only have the city of Austin and Travis Country been beneficent, but adjacent county governments and the state of Texas have provided abundant support. A 2014 study by the Workers Defense Project, in collaboration with UT’s Lyndon B. Johnson School of Public Affairs, reported that the state of Texas showers big business with $1.9 billion annually in state benefits. Most recently, officials with Travis County and a local school district granted Tesla more than $60 million in tax rebates to build a massive “gigafactory” southeast of town near Austin-Bergstrom International Airport.

To house the burgeoning cohort of “knowledge workers,” there are condominium conversions, tear-downs, high-rises and other forms of frenetic real estate development which, in their train, bring higher property taxes, steeper rents, and unaffordable housing.

Add in some of the country’s most snarled traffic, dirtier air, and a growing homeless population, and members of the artistic community are increasingly decamping for smaller satellite towns like Lockhart and San Marcos. Others in the diaspora are abandoning Texas altogether for more hospitable locales like Fayetteville Ark., Asheville, N.C., or Olympia, Wash. “Whatever made anybody think this would be a better town with a million people,” laments blues singer Ball. “This was a perfect town with 350,000. Now we’ve got Silicon Hills, Barton Springs are cloudy, and drinking water’s going to be scarce. Why is this supposed to be better?”

Add in some of the country’s most snarled traffic, dirtier air, and a growing homeless population, and members of the artistic community are increasingly decamping for smaller satellite towns like Lockhart and San Marcos. Others in the diaspora are abandoning Texas altogether for more hospitable locales like Fayetteville Ark., Asheville, N.C., or Olympia, Wash. “Whatever made anybody think this would be a better town with a million people,” laments blues singer Ball. “This was a perfect town with 350,000. Now we’ve got Silicon Hills, Barton Springs are cloudy, and drinking water’s going to be scarce. Why is this supposed to be better?”

The drop-off in live music and the belt-tightening by musicians is causing third-party pain for people like veteran Austin journalist and publicist Lynne Margolis, whose national credits include stories for Rolling Stone online, and radio spots for NPR. “The public relations aspect of my work has dropped away because artists can’t afford to pay,” she says, “and music journalism is falling by the wayside. It’s hard not to feel to like a double dinosaur.”

Led by bars, restaurants and music venues, on many days the solemn departure of small establishments has the business news sections of Austin newspapers reading more like the obituary page. One hardy survivor is Giddy Ups – a throwback honky-tonk on the town’s outskirts that advertises itself as “the biggest little stage in Austin” – promising “just about everything,” says owner Nancy Morgan, including “country, blues, rock, bluegrass, and soul.” For the past 20 years Giddy Ups has developed a devoted following of musicians and patrons while fending off hyper modernity.

“It has an untouched, back-to-the-seventies, cosmic cowboy vibe,” says local musician Ethan Ford, a guitarist and bass player whose trio, The Slyfoot Family, has graced its stage. “It’s a time capsule,” Ford adds.

Morgan declined to disclose her annual receipts but in 2019, she reports paying out $188,000 in wages to employees, $72,000 to musicians, and $185,000 in combined sales taxes to the city of Austin and to the state. Despite her status as a taxpayer, employer and entrepreneur, she has received no state aid and is disqualified from receiving city pandemic assistance programs, meager as they may be, because she’s located in an extra-territorial jurisdiction.“

Nancy still bartends most nights and does all of the booking,” says Ford. “Her knowledge of the Austin music scene could fill a couple of books. I know a decent fistful of Austin venue owners and she’s about the only one that hasn’t given up, been forced out, or just retired. She’s a dynamo.”

Unless the cavalry arrives for Morgan and other holdouts, though, their musical days may be numbered.

Editors Note: Threadgill’s didn’t make it. The venue “has closed for good, the property has sold, and the building will eventually be torn down,” according to information disseminated for its Last Call Music Series. Its November 1st grand finale show featured Gary P. Nunn, Dale Watson, Whitney Rose, William Beckman, and Jamie Lin Wilson.

The building will be replaced with apartments.

Treasury Warns of Audits as Public Companies Return PPP Money

April 28, 2020 In the wake of public outrage at the news that public companies have received millions of dollars from the Paycheck Protection Program, Treasury Secretary Steven Mnuchin today spoke out against such businesses. His comments come after the SBA and Treasury further clarified which businesses actually qualify for PPP, noting that only companies with no access to other forms of capital, such as selling shares or debt, would qualify.

In the wake of public outrage at the news that public companies have received millions of dollars from the Paycheck Protection Program, Treasury Secretary Steven Mnuchin today spoke out against such businesses. His comments come after the SBA and Treasury further clarified which businesses actually qualify for PPP, noting that only companies with no access to other forms of capital, such as selling shares or debt, would qualify.

Speaking on Fox Business, the Treasury Secretary explained that “anybody who took the money that shouldn’t have taken the money, one, it won’t be forgiven and two, they may be subject to criminal liability, which is a big deal … I encourage everybody to look at this and pay back these loans now so we can recycle the money if you made a mistake.” Mnuchin made clear that any company that receives a loan of over $2 million will be audited by the SBA.

A number of cases have made headlines, with Shake Shack and Ruth’s Chris Steak House returning $10 and $20 million, respectively, following calls from the public to refund it. Other publicly funded companies that have returned PPP money include AutoNation ($77 million); Penske Automotive Group Group ($66 million); and the Los Angeles Lakers basketball franchise, which received $4.6 million.

“I’m a big fan of the team but I’m not a big fan of the fact that they took a $4.6 million loan,” Mnuchin said of the Lakers. “I think that’s outrageous and I’m glad they returned it or they would have had liability.”

With the launch of the second round of PPP funding yesterday, the SBA reported that it had processed more than 100,000 loans by 4,000 lenders by 3:30pm that day. Senator Marco Rubio explained on Twitter that a new pacing mechanism had been integrated into the SBA’s E-Tran portal system, lowering the minimum amount of PPP loan applications required for lenders to send a bulk submission from 15,000 to 5,000. The hope for this is that it will enable smaller businesses to reach the funds through more regional lenders and “allow more banks to submit,” explained Rubio.

That’s All Folks? – The PPP Money Is Already Gone

April 15, 2020

Update 4/16/20: The SBA has put up an official statement on its website that says “The SBA is currently unable to accept new applications for the Paycheck Protection Program based on available appropriations funding. Similarly, we are unable to enroll new PPP lenders at this time.”

A number of fintech companies have just joined the Paycheck Protection Program, but they’re a tad late to the PPParty. On Twitter, Senator Marco Rubio, one of the co-sponsors of the CARES ACT that developed this program, confirmed the rumors that the well had run dry. “Sadly it appears #PPP will grind to a halt tonight as the limit on $ allocated to guarantee #PPPloans about to be hit.”

Sadly it appears #PPP will grind to a halt tonight as the limit on $ allocated to guarantee #PPPloans about to be hit.

Now 700000 small business applications are in limbo & no new loans will be made until the game of chicken in Congress ends & additional $ approved.

Inexcusable

— Marco Rubio (@marcorubio) April 15, 2020

Here’s the math

Congress approved $349 billion to guarantee #PPP

At 2pm today had over $300 billion in approved #PPPloans

Need $10 billion to cover fees & processing

When we reach $339 billion limit PPP will stop until they end with the ridiculous games & approve more funds

— Marco Rubio (@marcorubio) April 15, 2020

The SBA has often made reference to total funds “approved” when calculating its numbers rather than loaned out, so if you’re a business that has already been approved, then presumably funds have already been allocated for your business and you will still receive them. But if your application is pending, well it’s possible that funding may require additional congressional authorization. That however, as noted by Rubio’s remarks, will require some political compromise.

Update: 4/16 8 AM: Senator Rubio said on Fox Business that the PPP program was now frozen after having reached its limit and has stopped.

We’ll update this as more information becomes available.

Fox Business Funding is a new site sponsor... please welcome fox business funding as a new site sponsor! to learn more, visit:... |

See Post... fox business funding has been funding again for a few weeks. starting next week we will ease our restrictions, reach out if you are not already signed up.... |

Fox Business Funding Clawbacks... fox business funding, we earnestly hope you and your loved ones are safe during this difficult time., , in the unfolding fallout of the covid-19 crisis, many of your merchants have or are nearing default; as a result, those with... |

See Post... fox business funding... |

deBanked (MPR) has learned and confirmed that New York based funding provider,

deBanked (MPR) has learned and confirmed that New York based funding provider,